This blog provides a brief history of electric cars and an overview of the global and Indian scenarios, setting the stage for understanding a major player’s latest innovative move.

A Brief of the 200-year History of Electric Cars

It is fascinating to learn that electric cars were developed long before vehicles with internal combustion engines. Crude electric carriages were first invented in the late 1820s and 1830s, with practical, commercially available electric vehicles emerging in the 1890s. However, in the early 20th century, electric vehicles were not used as private motor cars due to their high cost, low top speeds, and limited range compared to internal combustion engine vehicles. However, electric vehicles remained used for loading and freight equipment, as well as in public transport, particularly in rail systems.

At the start of the 21st century, interest in electric and alternative fuel vehicles for private use surged. This renewed focus was driven by the rising price of petroleum and growing concerns about the environmental impact of hydrocarbon-fueled vehicles, the sustainability of traditional fuel-based transportation, and technological advancements in electric vehicles.

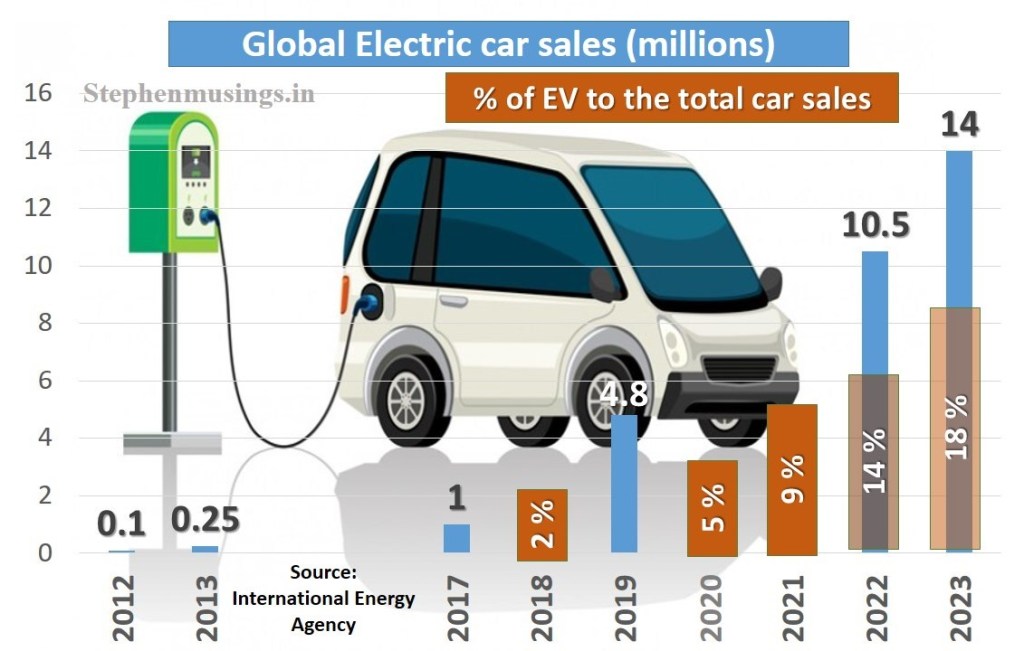

Since 2010, the electric car industry has seen significant growth. Global sales of all-electric cars reached 1 million units in September 2016, with 4.8 million electric cars on the road by the end of 2019. Sales of plug-in electric cars hit the 10 million mark by the end of 2020. In 2023, 14 million electric cars were sold globally, accounting for 18% of total car sales, with China, Europe, and the USA dominating over 90% of the market.

Leading global players in the electric car market are Tesla (USA), followed closely by BYD (China), Volkswagen(Germany), Toyota (Japan), Wuling (Indonesia), Nissan (Japan), Hyundai (S Korea), MG (China), and BMW (Germany).

The India Scenario

India’s electric vehicle (EV) market is still in its early stages. In 2022, EVs accounted for just 1.3% of car sales, with 49,800 electric vehicles sold out of 3.8 million passenger vehicles. This number grew to 82,000 EVs in 2023, making up 2% of all car sales. Sales are expected to increase by 66%, surpassing 4% of total car sales in 2024. Counterpoint Research shows EVs could represent nearly one-third of India’s total passenger vehicle sales by 2030.

The Indian government has actively supported the EV sector through financial incentives and subsidies under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme. FAME I was implemented from 2015 to 2019, followed by FAME II from 2019 to 2024. Further support will come through the Production Linked Incentive (PLI) scheme starting in 2024. The government’s current target is to achieve a 30% EV market share by 2030.

The growth of the electric car market varies across Indian states. SBD, a global automotive research firm, assessed infrastructure readiness for vehicle electrification in its second annual report.

The report includes four crucial factors: the distance between charging points, the capacity of the charging points, the ratio of EVs to the total number of vehicles, and the ratio of the number of charging points to the number of EVs. A review of the chart above allows us to understand the variation in EV adoption among different Indian states.

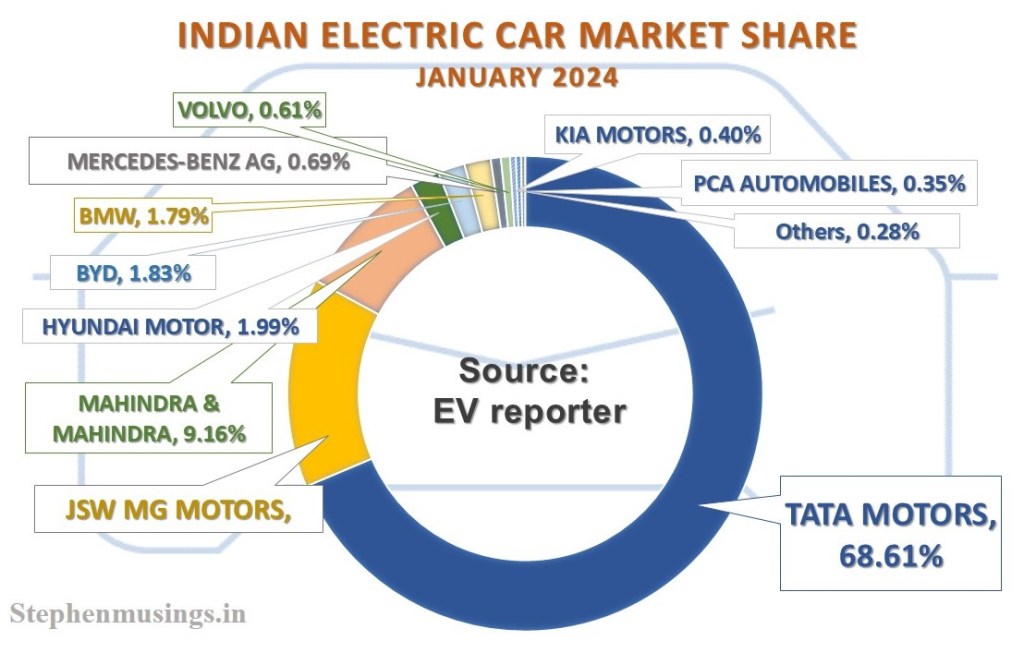

The January 2024 chart shows Tata Motors as the clear leader in the Indian electric car market, holding nearly 70% of the total EV sales. Tata Motors, the third largest in total passenger vehicle sales (including EV and non-EV vehicles) in India, gained the top market share in the EV segment by targeting the mass market. The company was the first to introduce electric vehicles priced below Rs 20 Lakhs in India. Its strong brand name, focus on eco-conscious and tech-savvy consumers, and extensive network of dealers across the country were key factors contributing to its success, enabling it to capture two-thirds of the market share.

Other Players in the Electric Vehicle (EV) Market (In Anticlockwise Order)

- Citroën (PCA – Citroën India): A French automotive brand owned by Stellantis, which was formed by the 2021 merger of Peugeot S.A. and Fiat Chrysler Automobiles N.V. Citroën holds only a 0.35% market share in India.

- Kia (South Korea): This South Korean company has captured a modest 0.40% share of the Indian EV market.

- Volvo (Sweden), Mercedes-Benz (Germany), BMW (Germany): These high-end EV manufacturers hold 0.61%, 0.69%, and 1.79% market shares, respectively.

- BYD Auto Co., Ltd. (China): A world leader in EVs and second only to Tesla globally in electric cars. BYD holds a 1.83% market share in India.

- Hyundai (South Korea): Hyundai has had a presence in India for some time, but its EVs account for just 1.99% of the market.

- Mahindra & Mahindra (India): This Indian conglomerate, which ranks fourth in overall car sales, is third in the EV segment, with a 9.16% market share.

- JSW MG Motors (India): stands second in the EV market with a 14.26% share.

JSW MG Motors: Innovation and Ambition in the Indian EV Market

MG (Morris Garages), a British automotive brand, is owned by Shanghai-based SAIC Motor. MG Motors India was established in 2017 by SAIC and began its sales and manufacturing operations in 2019 at a former General Motors facility in Halol, Gujarat. In 2023, MG Motors entered a joint venture with Indian conglomerate JSW, part of the Jindal Group, and is now JSW MG.

JSW MG Motors has introduced an innovative ownership scheme, inspired by the Software-as-a-Service (SaaS) model commonly used in the IT industry. In SaaS, users access cloud-based applications via the internet, paying for usage without owning the software itself. Common SaaS applications include email and office tools. MG Motors has adapted this model for the automobile industry, launching a Battery-as-a-Service (BaaS) in September 2024, as claimed the Industry first unique ownership programme.

The BaaS allows customers to purchase their EVs at a reduced upfront cost by excluding the battery price. Instead, users pay for the battery on a per-usage basis. For example, the MG Comet, initially priced at ₹6.99 lakhs, is now available at ₹4.99 lakhs under BaaS, with customers paying ₹2.50 per kilometer for battery usage. This makes the Comet one of the most affordable EVs in the market. Additionally, MG offers a buyback option at 60% of the purchase price after three years.

While the scheme is innovative and attractive, its success ultimately depends on consumer response. Buyers will weigh the pros and cons, and the market will decide whether this out-of-the-box idea takes off.

Industry Outlook

VinFast (Vietnam): The Vietnamese automaker has announced plans to build a factory in Tamil Nadu, investing ₹4,000 crore.

Tesla (USA): Elon Musk’s plans to establish a Tesla factory in India are currently on hold, but the future is still open.

The Indian electric car market is advancing rapidly, with manufacturers competing for consumer attention and market share. They are striving to capture our interest and wallets by offering a variety of options. Ultimately, we as consumers stand to benefit.

The Final Flip Flop: The government and environmental advocates promote electric vehicles (EVs) as a way to reduce carbon footprints. However, there are challenges that need to be addressed. For example, in Kerala, the demand for electricity far exceeds the supply, and the adoption of EVs could exacerbate the situation. The state is exploring alternative power sources, such as nuclear and coal, to tackle this issue.

The news report mentions that Kerala has been allocated 500MW coal linkages and can anticipate supply starting from 2025. This development may conflict with the green energy objectives of the EV movement. Will the promotion of EVs eventually result in greater reliance on coal power? Could we be transitioning from green power to black power?

—————————————-

Leave a reply to Ciby Cancel reply