The above Economic Times news report in the second week of February 2024 highlighted that the market capitalization of Tata’s 29 listed companies stood at $365 billion, making it bigger than Pakistan’s GDP. This information prompted me to ponder a few questions.

1. Are Corporations Outpacing Nations?

Pakistan holds the 41st position globally in terms of GDP among 177 countries. This implies that entities like Tatas surpass the economic output of 137 nations worldwide. To delve deeper into this comparison, the current most valuable company globally, Microsoft, with a market capitalization of $3.040 trillion, would secure the seventh spot in the global ranking of countries on a GDP basis, just above France. The countries with GDPs larger than Microsoft’s value include the US, China, Japan, Germany, India, and the UK. The trend indicates a notable growth of corporations, often eclipsing the economic scale of entire nations.

2. What is the value of the well-known entities Reliance and Adani? Upon investigation, I discovered that as of that date, their respective market values were $245 billion and $205 billion. This led me to the conclusion that the Tata group stands as the largest business empire in India, with Reliance and Adani following closely behind as second and third, respectively.

It is commonly understood that Reliance, led by Mukesh Ambani, is the foremost business house in India, trailed by the Adani group. One plausible reason for this perception could be that the salt-to-software Tata conglomerate is not typically viewed as a unified entity but rather as separate entities.

3. This line of thinking naturally led to my next question: if Mukesh Ambani and Gautam Adani are ranked as the 11th and 12th richest individuals globally, making them the top two wealthiest in India, then where do the Tatas fit into this hierarchy?

A search for an answer led me to the genesis of the Tata group. The beginning of the Tata legacy traces back to Jamsetji Tata, born into a Parsee family of priests in Gujarat in 1839. The Parsees, a distinctive community in India, are descendants of refugees who fled persecution in Iran, holding onto their Zoroastrian faith and culture. Breaking from tradition, Jamsetji’s father chose not to pursue the priesthood, establishing his private venture in Bombay, a path Jamsetji followed when he joined in 1858. Central to his business ethos were the principles of Zoroastrian faith: Humata, Huktha, Hvarashta—Good thoughts, Good words, Good deeds.

In 1868, Jamshetji Nusserwanji Tata laid the foundation of the Tata Group, earning the title of the “father of Indian industry.” The pivot of the organizational structure is Tata Sons, the promoter of Tata Group companies, holding a significant shareholding in these entities. Traditionally, the chairman of Tata Sons also serves as the chairman of the Tata Group. The Tata name and trademark, registered in India and numerous other countries, are owned by Tata Sons and utilized by various Tata companies for their products and services. Remarkably, about 66 percent of Tata Sons’ equity capital is held by philanthropic trusts established by Tata family members. Notably, the Sir Dorabji Tata Trust and the Sir Ratan Tata Trust, are the largest among these trusts.

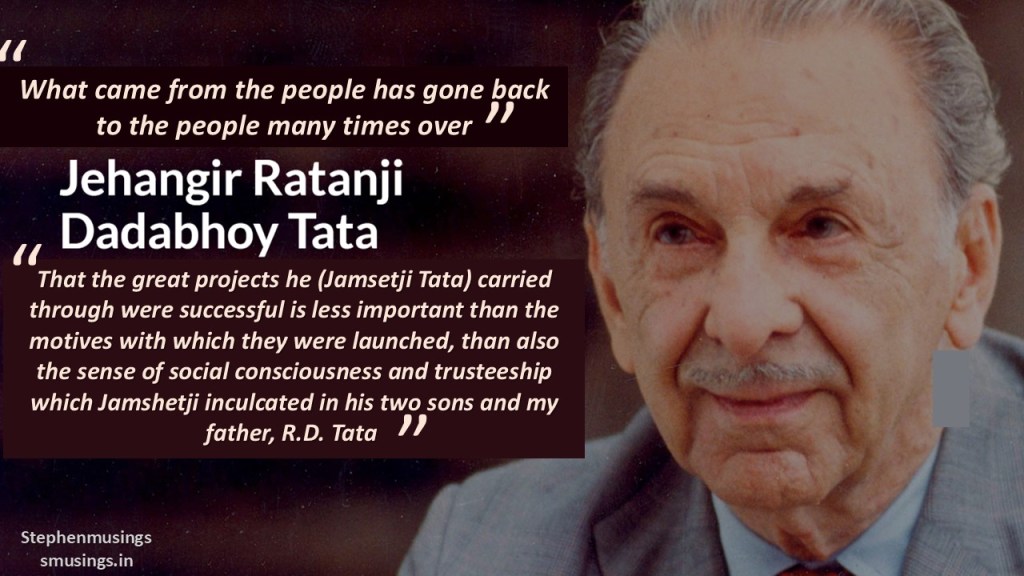

The tradition of trusteeship defines the Tata legacy. The Tata Group’s modus operandi, governed by the principle of trusteeship, presents a unique blend: inherently capitalistic yet profoundly socialistic in character.

Thus, the response to the query presented in the heading is this: Despite their status as one of India’s most prominent industrial families for well over a century, the Tatas do not appear in the typical ranking of the wealthiest individuals globally or in the country. This peculiarity arises from their dedication to directing a significant portion of their wealth into philanthropic trusts.

A theoretical estimation leads me to the following deduction: If the Tata family had held 63% shares of the Tata group ($365b), their riches would have surpassed that of the current wealthiest person globally, Bernard Arnault* & family, whose wealth stands at $228 billion (February 2024).

The reality is that Ratan Tata holds a meager 0.9% of the Tata shares.

4. The final question: With the Tata family and the Parsees themselves facing extinction, can the Tata Group uphold this philosophy? Ratan Naval Tata retired as chairman of Tata Sons in 2012. Cyrus Mistry, a member of the influential Parsi family Pallonji, which held an 18.3% stake in the company, was appointed the chairman of Tata Sons. However, Mistry’s tenure was short-lived due to differences with Ratan Tata, who still wielded significant influence as the head of the family. This led to Mistry’s removal in 2016, sparking a series of lawsuits.

Following Mistry’s departure, N Chandrashekaran, then-Chairman of Tata Consultancy Services (TCS), was appointed as the new chairman of Tata Sons. This transition raised questions about the continuation of the Tata philosophy.

[appendum on 14 October 2024] Ratan Tata passed away on October 9, 2024. Just two days later, Noel Naval Tata, Ratan Tata’s half-brother and the son-in-law of the Pallonji Mistry family, was appointed the chairman of Tata Trusts. This appointment provides clarity on the future leadership of the trusts, which hold a controlling stake in Tata Sons. With his extensive experience within the group and his commitment to philanthropy, Noel Tata is well-positioned to lead the trusts and ensure the legacy of the Tatas.

—————————————

*[Bernard Arnault is a French businessman, the founder, chairman, and CEO of LVMH, the world’s largest luxury goods company]

To read more on Bernard Arnault and his ranking click here

Leave a reply to CIBY JOSEPH Cancel reply