Let’s be cautious of such cons

We often come across the news of deposit scams. Ingenious con men offer innovative investment schemes, dangling extraordinary returns thereon. The gullible public deposit their hard-earned money, only to realise that their money has evaporated. Such scams are often reported as “Ponzi Schemes” in modern journalese.

Here is an indicative list of such schemes in the recent time.

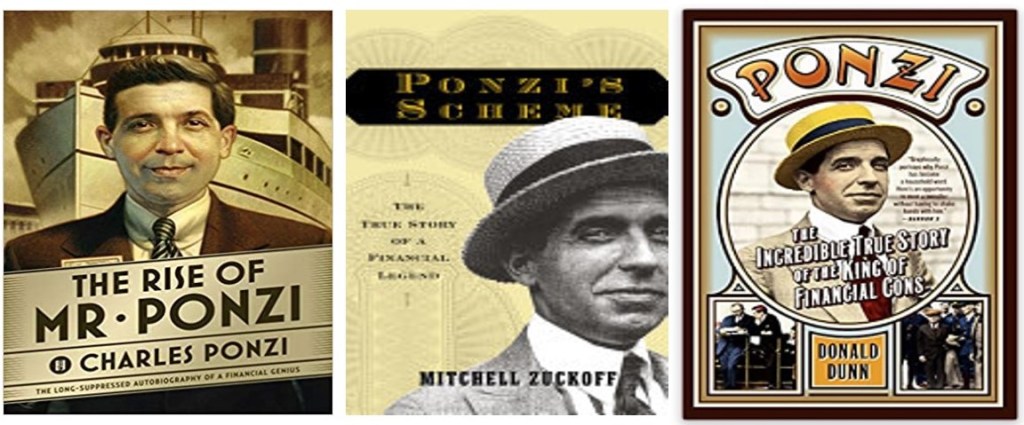

These schemes get their name from Charles Ponzi who may be considered to be the father of such investment schemes.

Charles Ponzi

The three books on Charles Ponzi reflects the diverse views on him. “The rise of Mr Ponzi; long suppressed autobiography of a financial genius”, Mitchell Zuckoff book Ponzi’s Scheme: The True Story of a Financial Legend, and biography by Donald Dunn, titled Ponzi: The Incredible True Story of the King of Financial Cons. Whatever he be – a Financial genius, legend or con, he has left an indelible mark on modern financial history and a name to easily explain such scams.

Modus operandi

Short statured (157 cm), 21 year old Italian immigrant Charles Ponzi landed on American soil in 1903. He drifted from one job to another – waiter in a restaurant to clerk in a bank. Then he started an advertising firm in Boston, which did not take off. Once he came across a mail from Spain attached with an ‘International Reply Coupon.’ The coupon permits a person to purchase it in one country and avail the postal service in another country. Pricing of the coupons was misaligned and widely varied between countries. Ponzi calculated that a coupon purchased in his country of birth, Italy, could be exchanged for US stamps for 230% margin; nearly two and a half times return. Ponzi immediately pounced on this business opportunity. With an earlier bitter experience over borrowing money from a bank, he decided to borrow in small sums from a large number of people. To add credibility to the venture he formed a company named Securities Exchange Company. Promissory notes of the company were issued at $10 at 50% return in 45 days which worked up to 400 % p.a. Ponzi started his operations around January 1920 and by May, he had made $ 420,000. He deposited a large portion in Hanover Trust Bank of Boston, and took controlling stake in the bank with an intention to become the President of the bank in the near future. Depositors were increasing from far and near and many of them getting the money from mortgaging their properties with a number of banks. Some of them reinvested their money back in Securities Exchange Company. Ponzi lived lavishly in a mansion with air conditioners and swimming pool, and moved around in a locomobile, which may be likened to a custom made Rolls Royce of our time. A feature on his life style occupied prominent space in a Boston newspaper in July 1920.

Downfall

Ponzi was under investigation as early as February 1920 by the postal and other legal authorities. Charles kept his cool and used clever tactics to slow down the investigation. The Boston Post newspaper continued the investigation on their own and dropped a bombshell on 2 August 1920 that Ponzi is in debt by $ 4.5m. On 12 August a Government auditor examined his book of accounts and reported that he was in the red by $ 3 m, later revised to $7m. Ponzi was arrested and initially sentenced to five year imprisonment, later extended to 14 years.

Along with the crashed scheme, five other banks also fell along with the Hanover Trust Bank. The investors were paid a final payment of around 30% and in all they lost $20 m in 1920 (valued around $240 m in 2020). The most intriguing fact was that Ponzi had invested only $3 in International Reply Coupon- the means he claimed to make his returns. In fact, he was revolving the money around for these seven months. The earlier investors were paid out of the later investors. This deposit scheme is termed as Borrowing from Peter to pay Paul and is now branded as Ponzi scheme. [1]

Con – confident personality

Charles Ponzi was a man of overflowing confidence. In his own words he landed in America, with, “$2.50 in pocket and $1 million in Hopes.” He did make millions of dollars, even if for a short period. His autobiography ends with his arrest in August 1920 and his closing sentences are “Life, hope and courage are a combination which knows no defeat. Temporary setbacks, perhaps, but utter and permanent defeat, never!” His definition of confidence is a combination of hope and courage. In fact the word ‘con’ refers to a person who wins confidence of another for his benefit. Charles Ponzi’s occupation is mentioned in Wikipedia as –“confidence trickster”, in short a con.

Charles Ponzi, hundred years old; Ponzi schemes ever green

The US federal Government, to protect the investors, passed Securities Exchange Act in 1934. The Securities Exchange Commission was set up in the very same year. This ironically seems to be the sequel to Securities Exchange Company started by Charles Ponzi’s. Later, similar Acts were passed and commissions operational in many countries across the globe. The latest Act was passed in India on 31 July 2019 entitled The Banning of Unregulated Deposit Schemes Act 2019. In spite of these laws, we see Ponzi schemes emerging every now and then from different parts of the world. Let’s have a look at the latest from the international front, which has many similarities with the original.

Stefan Qin Scammer crypto kid: twenty first century Charles Ponzi

Stefan Qin was born to South Korean parents. In 2016, at the age of 19, the self-proclaimed Math Prodigy dropped out of Australian University and started a hedge fund named Virgil Capital in New York. He claimed that he developed an algorithm to monitor crypto currency markets across the globe, thus to take advantage of the price fluctuations.Within one year of commencing the fund he showed 500% returns which resulted in a rush for his scheme. His marketing brochure featured 10% monthly return summed up to 2,811% for the three year period up to August 2019.

In February 2018, Wall Street Journal carried a feature on Stefan Qin’s skill at arbitraging crypto currency, which gave a boost to his fund. In September 2019, Qin, took on lease a $23,000-a-month apartment, a 64-story luxury building with a pool, sauna, steam room, hot tub and golf simulator. [2]

Federal prosecutors found the whole scheme to be a lie, essentially a Ponzi scheme. Qin used about $90 million from more than 100 investors to finance his lavish lifestyle and personal investments in such high-risk bets as initial coin offerings.

He surrendered to the authorities on February 4, 2021 admitting “I knew that what I was doing was wrong and illegal.” He was freed on a $50,000 bond pending his sentencing scheduled for May 20, 2021.

Morris coin scam by a Keralite

Nearer home there was a crypto currency scam which originated from Kerala. 36 year old Nishad K. of Pookkottumpadam, Malappuram, Kerala, orchestrated this scheme. Ten Morris coins, a crypto currency, was offered for a minimum investment of Rs 15,000. The tantalizing return offered was Rs 270 per day for 300 days.

Nishad was arrested in September 2020 under Prize Chits and Money Circulation Schemes (Banning) Act. However, the police have not received any complaints from the investors.

Mother of Ponzi schemes fathered by Bernie Madoff

Ponzi schemes have cropped up in different formats during these hundred years. The largest of them, which may be termed the mother of these schemes is the one started by Bernie Madoff. It lasted nearly two decades, longest so far. He created a front of respectability, gaining the investors’ trust by offering his returns which were high but not unusual and he claimed to use a legitimate strategy. Madoff was a pioneer in electronic trading and acted as chairman of the Nasdaq in the early 1990s. Securities Exchange Commission received the first complaint against Madoff in 2000, but the regulator ignored it.

Madoff simply deposited client funds into a single bank account that he used to pay existing clients by attracting new investors. He was unable to continue when the market slumped in late 2008. He confessed to his sons—who worked at his firm but, he claims, were not aware of the scheme—on Dec. 10, 2008. They turned him in to the authorities the next day.

In 2009, at age 71, Madoff pleaded guilty. Madoff was sentenced to 150 years in prison. Bernie Madoff’s scheme cost his investors about $18 billion, the largest so far. [3]

Madoff died on 14 April 2021 while serving the sentence. He was 82.

Features of a Ponzi scheme

It is helpful for prospective investors to know a few things about Ponzi schemes in general. Ponzi schemes reappear in different formats but do have the following features:

- Attractive façade: if it was the International Reply Coupon in the original scheme, in the latest crypto-currency was projected as means to multiply the money. They included god’s money, pigeon race, ants, milk, boy band, hotel rooms, and so on. Their operation is opaque to a certain extend. They also mystify the scheme. [4]

- Offer of tempting returns: such schemes offer tantalisingly attractive returns. They often promise returns far above the normal prevailing rates in the market. Exception might be that of Madoff who gave only reasonable return, but he made it steady for over a long period which is quite abnormal in the stock market.

- The Fund operator displays overconfidence: The scheme operator will be overflowing with confidence with which he gains the trust of the prospective investors.

- Does not generate any revenue from the fund: this is the single distinguishing feature, but can only be made out from internal sources. An objective and exhaustive examination of the books of accounts can reveal it. The funds received are not utilised to generate any returns. The earlier investors are duly paid out of the new investors and so the initial investors will gain from such schemes.

Why they succeed: human insight

In spite of repeated failures of Ponzi schemes, and laws and regulators on the watch out, Ponzi schemes crop up every now and then. How do they succeed, even if for a short while?

The reason lies within us human beings, in our psychosis. Charles Ponzi claimed, “I knew human nature”. He wrote: “Because we are all gamblers. We all crave easy money. And plenty of it. If we didn’t, no get-rich-quick-scheme could be successful.…Each satisfied customer became a self-appointed salesman. It was their combined salesmanship, and not my own, that put the thing over. I admit that I started a small snow ball downhill. But it developed into an avalanche by itself.”

Bernie Madoff had this to say: “Everybody was greedy, everybody wanted to go on and I just went along with it.”

No laws, no regulators can put a stop to such schemes. Unless and until we, human beings learn to curb our greed that fosters the get-rich-quick mentality, Ponzi schemes will continue to emerge and disappear with the money invested therein.

Tail twist:

While discussing this topic with my son, he asked me a question which made me think: “What about government deposits, are they Ponzi schemes? I intend to reflect on this in the next blog.

Comments welcome

Do post your thoughts on the Ponzi schemes and your answer to the question raised by my son.

Leave a comment