The human being, any living organism for that matter, goes through different phases of existence during its lifetime. We call it the life cycle

Beginning at birth and ending with death, one moves from childhood to teenage, youth, middle age, old age, and finally to dotage.

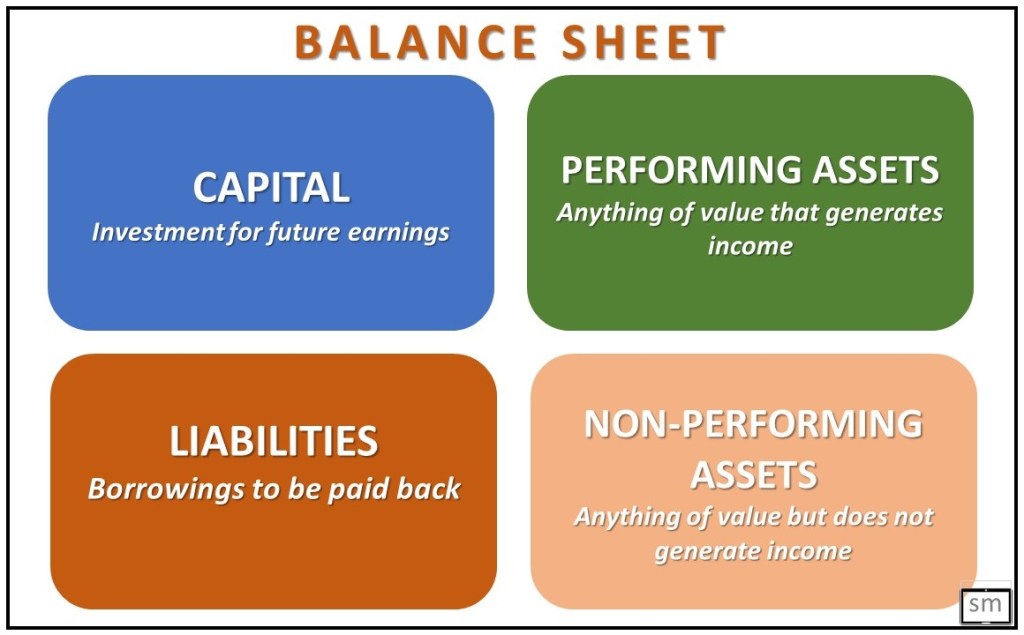

These stages in our life cycle may be compared to the four elements in a balance sheet. Let’s take a look at these elements in a Balance sheet.

What is a Balance Sheet?

A balance sheet is the fundamental financial statement of any organization, business, or non-business; for-profit or non-profit; government or non-government. It is a snapshot of the financial status of the organization at a specified date.

The balance sheet elements can be classified in various ways. For the purpose at hand, the elements can be briefly described as capital and liabilities on the left side and performing and non-performing assets on the right side.

Capital is the fund invested by the owners or shareholders of the organization. This is an amount set aside in expectation of the performance and growth of and returns from the organization. Liabilities refer to the borrowings from outsiders who are to be paid back with interest. This is a burden the organization must settle in the future.

Assets are anything of value expected to generate benefits for the organization. But it turns out that some assets produce benefits, while others do not. According to the Reserve Bank of India, an asset becomes non -performing when it ceases to generate income. Thus, in banking terms, assets may be classified as performing assets and non-performing assets. They may also be referred to as productive, and non-productive assets.

How does the lifecycle fit into the Balance Sheet?

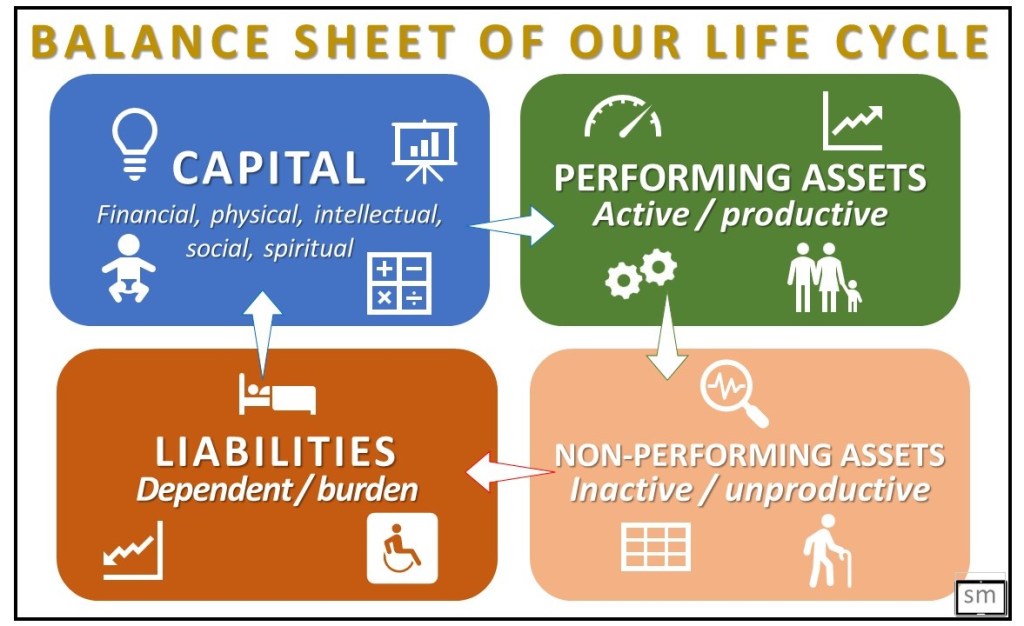

While a balance sheet pertains to only financial affairs, our life cycle goes beyond financial dealings. When we are born on this earth we are looked upon with many expectations. The parents, family, and society spend money, time, and effort in molding the child physically, intellectually, socially, and spiritually.

Thus, the child is the capital. The child is anticipated to be valuable and provide benefits, financial and otherwise to the parents, family, and society at large,

After a time, the child grows up to be mature physically, intellectually, socially, and spiritually. Becomes independent earns on his/her own and builds a family. They start generating benefits for the family and society at large. Physically, as people get old, they may not be able to contribute for others and so may be termed non-performing assets. As they still get older, they are not able to take care of themselves physically and need help from others for their daily chores. They may be perceived as liabilities.

The activities we indulge in are not confined to economic/financial in nature. For example, housewives, or imam/pujari/priest, are very much engaged in productive activities from a social or spiritual perspective respectively.

Even when we get wiped out of this world, we may leave behind something for the next generation, financially, intellectually, socially, and spiritually. We leave behind a legacy, a capital for the next-gen, which they can bank on.

What is the role of immigrants in Balance sheet of developed countries?

In a robust and successful business firm, the performing assets far exceed the liabilities. Conversely, when the liabilities far outweigh the performing assets, the firm will be declared bankrupt and folded up. A society or a country consists of all these elements in the balance sheet. It is found that the performing assets (active population) must take on the burden of the liabilities (dependent population). The progress of a society or a country will stagger, when the extent of its liabilities exceeds that of the performing assets. In developed countries, read economically advanced countries, the rate of growth of liabilities is far more than the performing assets. As these countries have no means to increase the performing assets within the country, they have opened the boundaries, and liberalized the procedures, to welcome immigrants from other countries.

Advantage India

As a nation, India’s Balance sheet is robust as its assets far outnumber the liabilities. This is often referred to as the demographic dividend. Only that our assets are not as active or productive as they can or should be. They are leaving India in droves to where they are needed to be productive/performing assets. If this brain drain is not stemmed, India will lose this Balance sheet advantage.

An anecdote to explain the terms

This is a story I heard from an elderly neighbour. Six friends were whiling away their time. A person comes along and asks them to carry a heavy log across a shallow river. Five of them volunteer and take the trunk of the tree on their shoulders and start walking across the river, with knee-deep water. As they walk across, a few of them feel the log to be heavier than before. As soon as they reached the other side of the river and put down the log in the required place, they looked around. Three of them found that their feet were wet and the other two had dry feet.

The story explains the distinction among the three terms stated above. The one person who did not join and watched the others doing the task is the non-performing asset. Those three who had wet feet are the performing assets. The two who were hanging on to the log and adding their weight on others, while crossing the river, are the liabilities. As a part of a community, society, or economy, each one of us, consciously or unconsciously takes on these various roles in our transactions.

Personal dilemma

As a pensioner, in the twilight of one’s life, I am in doubt “what am I” in this balance sheet, performing or non-performing asset, liability, or capital?

——————————-

Leave a comment