This is the third and final part of the blog on this topic. To read part 1 covering the theoretical built up to the topic click here. To read part 2 dealing with the actual data on the debts of nations click here.

Is the world in the brink of Ponzi financing?

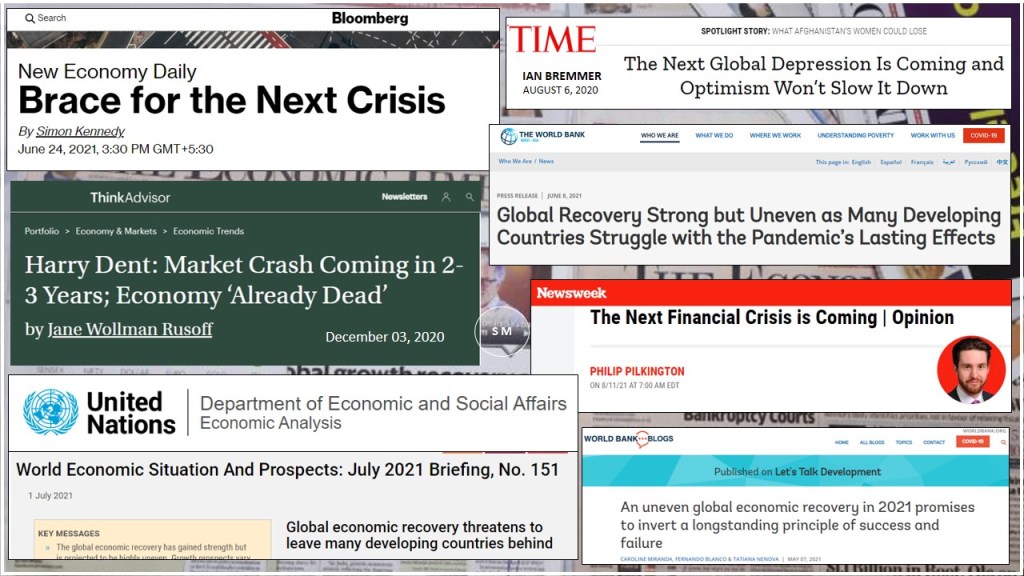

Almost all the countries on the globe, in lesser or greater intensity, are immersed in the act of saving the lives of the people from the pandemic. In the process they are taking various measures including pumping in more and more money to stimulate the economy, raised through debts. This is aggravating the extend of the ponzi financing, forcing the countries to move towards its brink. Have we reached the ‘Minsky Moment’?. What does the experts say? Lets have a look at the media captions on financial crisis in the recent months.

The captions vary from: the economy is dead – crisis is coming – nothing to stop crisis – prepare ourselves for crisis. Philip Pilkington, [1] the economist states “A mouse to scare the market elephant. The markets are almost certainly deep into the late stages of a bubble. At some point, something will spook them. Some more inflation, perhaps; maybe the threat of a Fed hike; or perhaps an extended failure to get the virus under control. . . Then we may be facing another large-scale financial crisis” according to him the crisis is imminent, but do not know how and when.

Ian Bremmer writes in Time online [2] that it will be a depression: that cuts deeper into livelihoods, and its bad effects will last longer than the recessions of the past 80 years, that is, since World War II.

Latest UN briefing in July 2021[3] does not even hint at an economic crisis and states that global recovery will be uneven and will be varying from economy to economy, region to region and country to country, depending on the rate of vaccination and opening up of the economy, effectiveness of government stimulus packages, dependence on international tourism and so on.

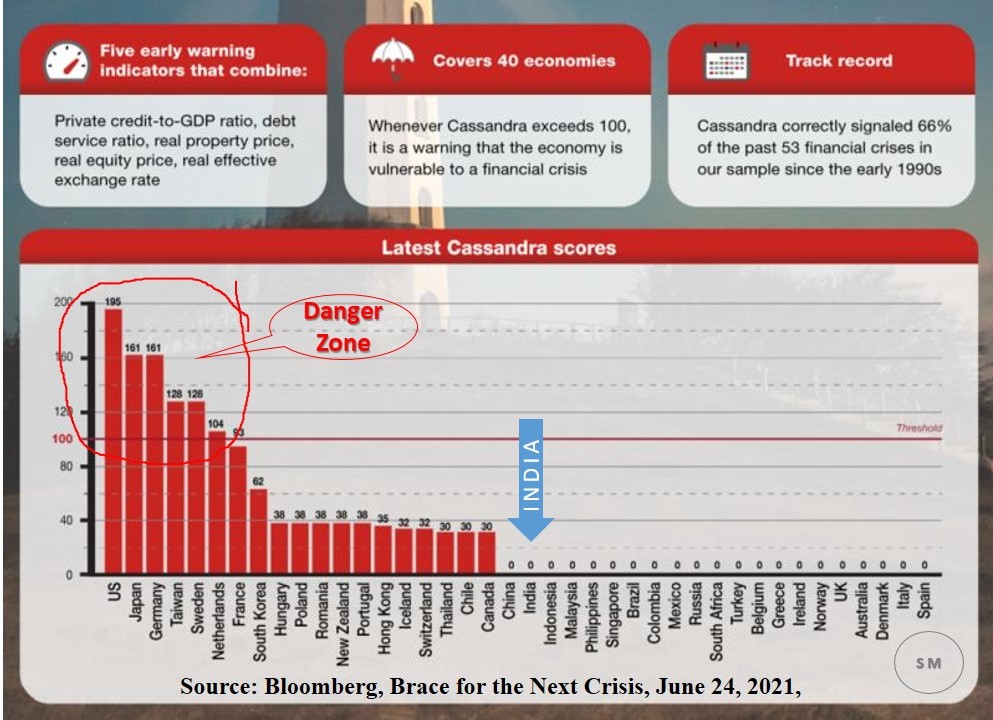

Above is Cassandra, [4] afinancial crisis prediction model, which had been accurate 66%,designed by Rob Subbaraman at Nomura, the Investment Management and Global Research Company. Those countries above the threshold score of 100 are prone to financial crisis. As shown in the figure, six countries, US, Japan, Germany, Taiwan, Sweden and Netherland are likely to face financial crisis within the next three years. Five of them, except Taiwan, also were found to have high Debt-GDP ratio in chart 3.

The countries across the globe, battling with the still unfathomed, common enemy COVID-19, are in economic recession, a recession caused by this extended battle. The recovery from this recession will depend on: (a) how soon we can conquer the pandemic (b) the economic condition the country was in before the pandemic, including their debt burden, and (c) the means and mode employed by the countries in this unprecedented battle. Thus a few may plunge into depression in varying depths, taking years to recover. The few others may still be in the recession and recover in a short time. There are a few countries who are already in the recovery path.

What about India? According to the Cassandra chart given above, India is outside the danger zone. That is to say that the probability for India plunging into financial crisis is very low, along with China, Indonesia, Malaysia, Philippines, Singapore, Brazil and others. India has no imminent danger of a financial crisis. We have another encouraging finding on India. The UN briefing in July 2021 [3] states that strong economic rebound during the latter part of 2020 was experienced in countries such as China, India, Malaysia, Peru and Turkey. UN briefing adds that these countries need to sustain a strong growth momentum in coming years to emerge out of the situation. To continue with positive news in this front, World Economic Outlook Projections by IMF [5] denotes India’s GDP growth in 2021 and 2022 at 9.5% and 8.5% respectively, the highest among all the countries. India is projected to take lead in the recovery process.

A caution may be appropriate: we are still in the woods, in the midst of the pandemic, not out of it. IMF believes in the economic base of India and hopes that India will be in the vanguard of the march to economic recovery. Let my country arise to such expectations.

What is the way forward?

Neoliberal economic model promoted deregulation, reduced supervision and monitoring, privatisation and consolidation of market power. Prevalence of the model in advanced countries was evident from lesser and lesser control by the governments on the one side and more and more freedom granted to the market forces on the other side. Hyman Minsky was against this model. In Minsky’s words [6] “It is time to finally put global finance back in its proper place . . as we did in the aftermath of the Great Depression. This means substantial downsizing and careful re-regulation. Government must play a bigger role, which in turn requires a new economic paradigm that recognizes the possibility of simultaneously achieving social justice, full employment, and price and currency stability through appropriate policy.” Minsky was listened to, especially after the crisis in 2008. There are evidences to show that the governments are taking control over the economies. Mckinsey Global Institute comprehensive study on global debt in 2017 [7] came out with the finding that Central banks are playing a larger role in financial markets. This denotes the shift to Minsky’s paradigm, where the governments have a greater role, rather than leaving the economy to the market forces.

What are the long term measures for containing the mounting debts?

There are no quick fixes or immediate solutions for clearing the mountain of debt piled up through the decades, leading ponzi financing in a number of countries. Boston Consulting Group (BCG) [8] published a seminal paper in January 2013, based on the study made on developed countries for the five years after the financial crisis of 2008. The paper looked into causes that led to the crisis and suggested measures to resolve them. The steps proposed are demanding and challenging as they exhorted all stakeholders to bear the brunt of such debt cutting measures. They included: austerity measures by government, higher taxes, raise in retirement age, increase efficiency of governments, smart immigration policy, proper education, support family formation, cooperation on global basis, incentives for innovation… a closer look at these steps will make us realise that they are pragmatic, but calls for determined leadership at the national and global level.

What is the role of governments and the citizens?

The major lesson the world has learned from the confrontation with the pandemic is that we need determined governments in power that can effectively manage the situation and that we cannot let the market or other forces take its own course. The governments across the globe are currently focusing their efforts in flattening the COVID-19 wave. The governments should be as zealous in lowering, if not flattening, the mountain of debts, which took them to the brink of Ponzi financing. The primary solution, as given in the book Planet Ponzi [9] is an Honest Government. To quote Mitch Feierstein, the author of the book “If honesty and transparency are to become the first watch words of governments, they need to become the watchwords of voters too.”

The last question in this discourse is posed to us: Are WE honest and transparent?

References:

[1] Philip Pilkington, The Next Financial Crisis is Coming | Opinion, www.newsweek.com August 11, 2021

[2] Ian Bremmer, The Next Global Depression Is Coming and Optimism Won’t Slow It Down, time.com, August 6, 2020

[3] World Economic Situation and Prospects: July 2021 Briefing, No. 151, UN, 1 July 2021

[4] Simon Kennedy, Brace for the Next Crisis, Bloomberg, June 24, 2021

[5] World Economic Outlook Update, IMF, July 2021

[6] Financial Instability Hypothesis and Current Common Problems of Rich Capitalist Economies, Hyman Minsky, Jerome Levy Institute Bard College, Hudson New York, November 7, 1994

[7]Rising Corporate Debt Peril or Promise? Mckinsey Global Institute, June 2018

[8]Collateral Damage, Ending the Era of Ponzi Financing, Boston Consulting Group, January 2013

[9] Mitch Feierstein, Planet Ponzi, , Bantam Press, 2012

Leave a comment