This is the first of a three parts series on the topic. This portion only covers the theoretical background.

What is Ponzi Scheme?

Ponzi scheme, named after Charles Ponzi, [1] refers to an investment scheme resorted to by miscreant individual, who attract investors by offering enticing returns, but keep alive their scheme by utilising the newer investors’ money to pay off the earlier investors. Such schemes get exposed sooner or later and crumble down like house of cards taking away the investments of the public. Bernie Madoff [2] who strategized the biggest and the longest surviving Ponzi scheme to date was imprisoned in 2008 with 150 years sentence. Madoff died at the age of 82 in prison on 14 April 2021.

What is Ponzi financing?

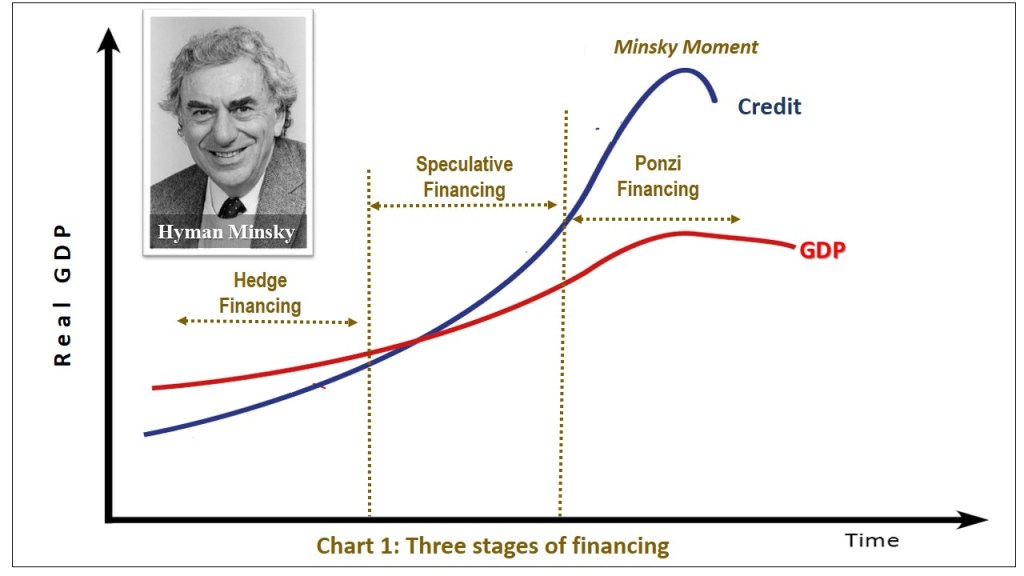

The term Ponzi was used in the public finance by the American economist Hyman P Minsky (1919-1996). Minsky is the exponent of ‘financial instability hypothesis.’ He distingushes three stages of financing: (i) Hedge financing, the safest, where the borrowers have the capability to repay both the principal and the interest; (ii) Speculative financing, a slightly risky, when the borrowers can only afford to pay the interest and rolls over the principal; (iii) Ponzi financing, the riskiest, occurs when the borrowers can afford to pay neither interest nor the principal.

When the economy progresses, more and more money will be available for lending. Banks and lending institutions become less and less cautious and lend to borrowers who have no capacity to pay back. Minsky states that when the economy looks stable and favourable the financing moves from Hedge to Speculative to Ponzi financing. It continues till it reaches the breaking or inflection point leading to a financial crisis. This point was later described by other economists as ‘Minsky Moment’.

Thus the underlying idea is ‘stability breeds instability’ or ‘stability is destabilising’.

The hypothesis published by Minsky in 1982 was ignored by the academia and the main economists and it caught their attention only after the financial crisis of 2008 and it was accepted as an explanation for the downturn.

[1] To read Charles Ponzi,the father of ponzi schemes, by Stephen Mathews, April 7, 2021 click here

[2] To read Bernie Madoff fathered the mother of ponzi schemes, Stephen Mathews, April 16, 2021, theweek.in click here

To get to know status of the global economy read part -2. To reach part 2 click here

Leave a comment